As a retailer, you are mostly working on thin margins. In the world of fast moving customer goods, you mostly work between 2 and 5 % of EBIT, with gross margin of 25 to 30%.

While working on a category, and especially working on its profitability, we mostly use the gross margin approach, either in % or in value, to know what is profitable or not. But I believe that it is very short in terms of approach.

Indeed, a lot of aspects may impact your gross margin in several ways, which may change deeply the final profitability of one of your products. For instance, you may have a high margin on a product (let's say 40%), but if it moves slow, it will have a costly impact on your inventory or your cashflow, whereas a fast mover may have a 20% margin but will be far more profitable. Other items have an impact on the margin, for example, the transportation of it.

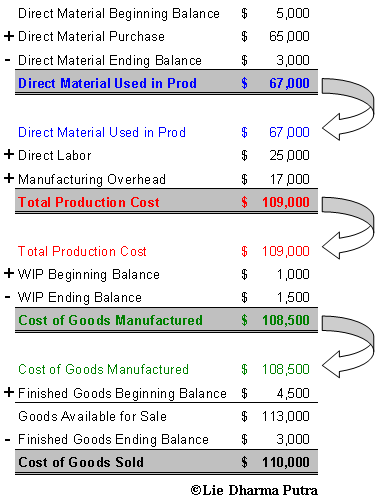

It is what we call the cost of goods sold. This approach allow you to have a kind of "EBIT" per product, and hence to see the real cost of some products that hide their performance by a high % of margin.

Here are some items that may have a deep impact on your costs:

- How fast the sales go (for inventory for example)

- The breaking/ stealing (for high cost goods, or fresh food)

- When you pay the merchandising (the later the better to have a positive cash flow, depending on how fast you sell the product)

- The supply chain

The Cost of goods sold approach is very important and should be developped at all time to better understand the impact of your category choices.